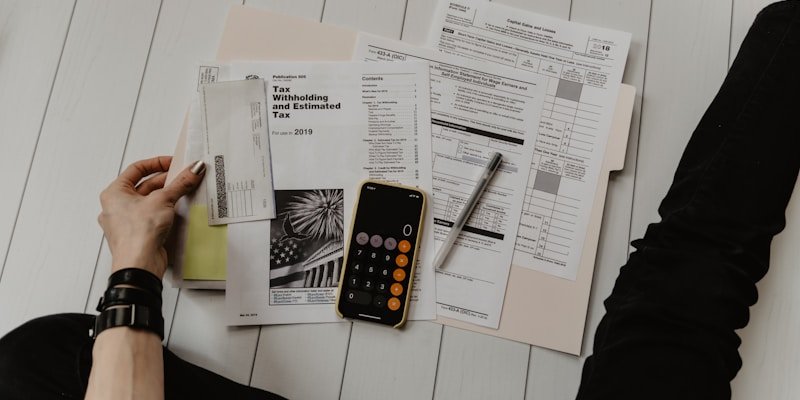

Preparing corporate tax returns can be daunting, requiring a thorough understanding of tax laws and regulations. Any mistakes or inaccuracies can result in financial penalties and legal complications. Here's why hiring professionals is crucial for corporate tax returns.

**Complexity of Corporate Tax Returns:**

Corporate tax returns involve multiple forms, schedules, and complex calculations that require specialized knowledge and experience.

**Key Benefits of Professional Corporate Tax Services:**

1. **Expert Knowledge**: Professionals stay updated with constantly changing tax laws and regulations.

2. **Compliance Assurance**: Ensures your corporation meets all filing requirements and deadlines.

3. **Strategic Planning**: Helps optimize your corporate structure for tax efficiency.

4. **Audit Protection**: Professional representation during tax audits or inquiries.

5. **Cost Savings**: Identifies legitimate deductions and credits to minimize tax liability.

6. **Time Efficiency**: Allows you to focus on running your business while experts handle taxes.

**Common Corporate Tax Challenges:**

- Multi-state tax obligations

- Complex depreciation calculations

- Transfer pricing issues

- International tax considerations

- Employee benefit taxation

**What to Look for in a Corporate Tax Professional:**

- Relevant certifications and experience

- Knowledge of your industry

- Track record of successful filings

- Availability for year-round consultation

At LiraTax & Accounting, our corporate tax specialists have extensive experience helping businesses of all sizes navigate complex tax requirements. We provide comprehensive corporate tax services that ensure compliance while maximizing your tax benefits.

Contact us today to learn how our professional corporate tax services can benefit your business.