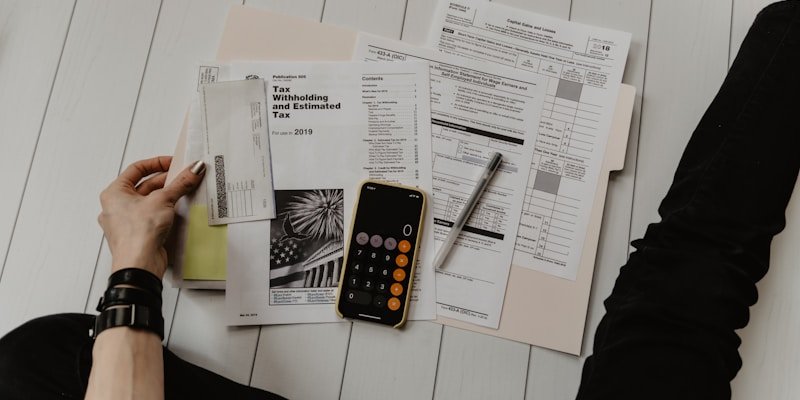

When it comes to preparing and filing tax returns, many people choose to hire a professional tax preparer rather than take the DIY route. Let's explore the compelling reasons why professional tax preparation services are essential.

**Top Reasons to Choose Professional Tax Preparation:**

1. **Accuracy and Compliance**: Professional preparers ensure your returns are accurate and compliant with current tax laws.

2. **Time Savings**: Save valuable time by letting experts handle the complex paperwork.

3. **Maximize Deductions**: Professionals know all available deductions and credits you might qualify for.

4. **Avoid Penalties**: Reduce the risk of errors that could lead to costly penalties and interest.

5. **Audit Support**: Professional representation in case of IRS audits or inquiries.

6. **Peace of Mind**: Confidence that your taxes are handled correctly and on time.

**What Professional Tax Preparation Includes:**

- Comprehensive review of your financial documents

- Identification of all eligible deductions and credits

- Accurate calculation of tax liability

- Timely filing of returns

- Ongoing support and advice

**Cost vs. Benefit Analysis:**

While there's a cost associated with professional tax preparation, the benefits often far outweigh the expense. The potential savings from proper deductions and the peace of mind are invaluable.

At LiraTax & Accounting, we provide comprehensive tax preparation services for individuals and businesses. Our experienced team ensures accuracy, maximizes your savings, and provides ongoing support throughout the year.

Contact us today to experience the difference professional tax preparation can make for your financial well-being.