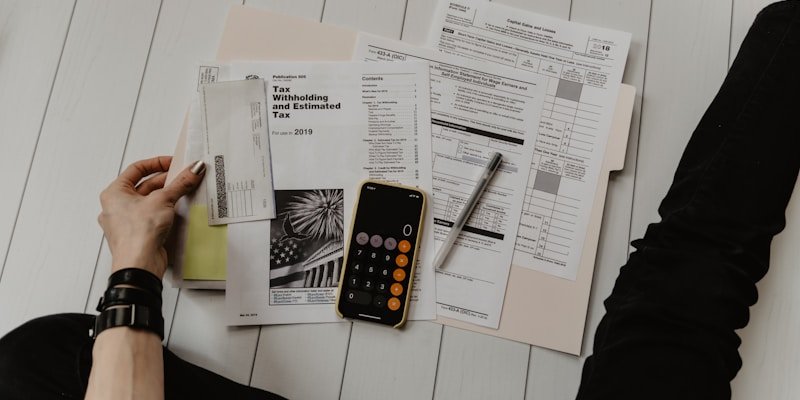

We are all aware of the tendency of misunderstandings to expand beyond their original scope. The same is true for services for outsourcing tax preparation. Let's demystify some common misconceptions about tax preparers and the services they provide.

**Common Misconceptions About Tax Preparers:**

1. **"Tax Preparers Only Work During Tax Season"**

- Reality: Professional tax preparers work year-round

- They provide ongoing tax planning and consultation

- They help with quarterly tax payments and planning

- They assist with tax-related business decisions

2. **"All Tax Preparers Are the Same"**

- Reality: Tax preparers have different specializations and expertise levels

- Some focus on individual returns, others on business taxes

- Different certifications and qualifications exist

- Experience levels vary significantly

3. **"Tax Preparation Is Just Data Entry"**

- Reality: Tax preparation involves complex analysis and strategy

- Requires understanding of tax laws and regulations

- Involves strategic planning and optimization

- Requires ongoing education and training

4. **"I Can Save Money by Doing My Own Taxes"**

- Reality: Professional preparers often save you more than they cost

- They identify deductions and credits you might miss

- They help avoid costly mistakes and penalties

- They provide year-round value through planning

5. **"Tax Preparers Are Only for Complex Returns"**

- Reality: Even simple returns can benefit from professional preparation

- Ensures accuracy and compliance

- Provides peace of mind

- Establishes relationship for future needs

**What Professional Tax Preparers Actually Do:**

**Comprehensive Tax Services:**

- Tax return preparation and filing

- Tax planning and strategy development

- Quarterly tax payment planning

- Audit representation and support

**Ongoing Consultation:**

- Year-round tax advice and planning

- Business tax strategy consultation

- Investment tax optimization

- Life event tax planning

**Specialized Expertise:**

- Industry-specific tax knowledge

- Complex tax situation handling

- International tax considerations

- Estate and trust tax planning

**Value-Added Services:**

- Financial planning integration

- Business consulting services

- Investment advice coordination

- Estate planning support

**Choosing the Right Tax Preparer:**

- Look for relevant certifications and qualifications

- Consider their experience with your type of situation

- Evaluate their communication and availability

- Assess their approach to tax planning and strategy

At LiraTax & Accounting, we're committed to providing transparent, professional tax services that go beyond simple tax preparation. Our team works year-round to help you optimize your tax situation and achieve your financial goals.

Contact us today to experience the difference professional tax preparation can make for your financial well-being.