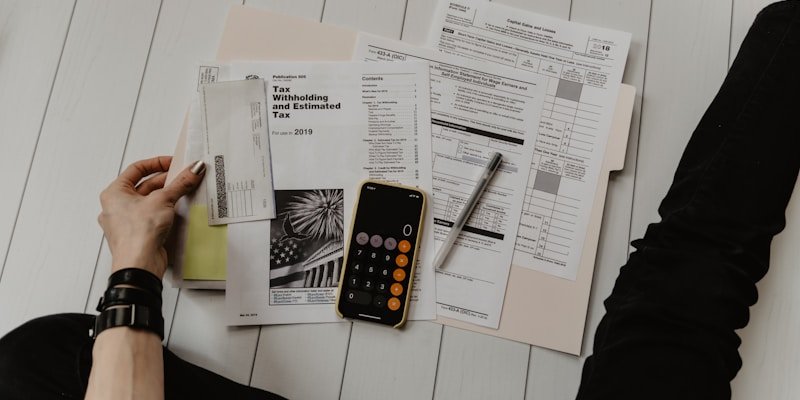

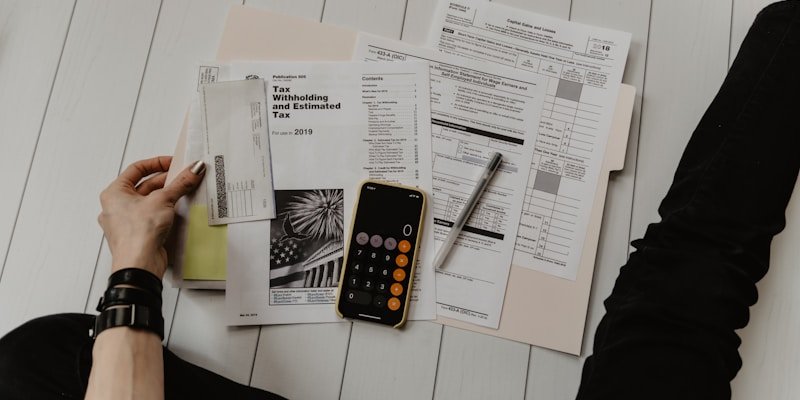

Preparing for an audit can be a daunting task, but it's essential to ensure your financial records and processes are in order. An audit can be stressful, but avoiding common mistakes can make the process smoother and more successful.

**3 Common Audit Preparation Mistakes:**

1. **Incomplete Documentation**

- Missing receipts and invoices

- Inadequate record-keeping systems

- Failure to maintain supporting documents

- Inconsistent documentation practices

2. **Poor Organization**

- Disorganized financial records

- Missing chronological order

- Inadequate filing systems

- Difficulty locating specific documents

3. **Lack of Professional Guidance**

- Attempting to handle complex audits alone

- Not seeking expert advice early

- Underestimating audit complexity

- Inadequate preparation time

**How to Avoid These Mistakes:**

**Improve Documentation:**

- Implement systematic record-keeping

- Maintain all receipts and invoices

- Use digital storage solutions

- Regular document review and organization

**Enhance Organization:**

- Create logical filing systems

- Maintain chronological records

- Use consistent naming conventions

- Regular system maintenance

**Seek Professional Help:**

- Consult with tax professionals early

- Get expert guidance on complex issues

- Prepare thoroughly with professional support

- Understand your rights and obligations

**Audit Preparation Best Practices:**

- Start preparation early

- Gather all required documents

- Review records for accuracy

- Prepare explanations for unusual items

- Maintain professional demeanor

At LiraTax & Accounting, we help businesses prepare for audits and provide ongoing support throughout the process. Our experienced team can guide you through audit preparation and represent you during the audit process.

Contact us today to ensure you're properly prepared for any audit situation.